In the weeks following the outbreak of the coronavirus, the Australian market drifted down. Then came the reaction.

On March 13, 2020, the Australian Securities Exchange (ASX) recorded its worst day since 2008, as coronavirus fear gripped the market. In the first 15 minutes of trading, it plunged more than 7 per cent.

After weeks of ‘drift’, Australian investors had finally grown alarmed. But what had taken so long?

A new study reveals how Australian investors at first under-reacted to coronavirus fear, at a loss with how to interpret the unique nature of the pandemic and grappling with a lack of prior experience or knowledge in gauging the extreme uncertainties it imposed.

The study also shows how the first Federal Government stimulus payment markedly shifted market sentiment, causing a rebound effect that bolstered the market.

A lecturer in the Department of Accounting, Dr Dharmendra Naidu with a recent PhD graduate Dr Kumari Ranjeeni studied the market reaction to both the fear of the coronavirus and the impact of the Australian Government’s stimulus packages to see what effect it had.

On March 13, 2020, shares on the Australian Securities Exchange plunged more than 7 per cent in the first 15 minutes of trade, the worst losses since the 2008 Global Financial Crisis.

How investors reacted

Recently published in Pacific-Basin Finance Journal, the study is a fascinating look at a snapshot of investor reaction to the event.

No one really knew what effect this would have on financial markets.

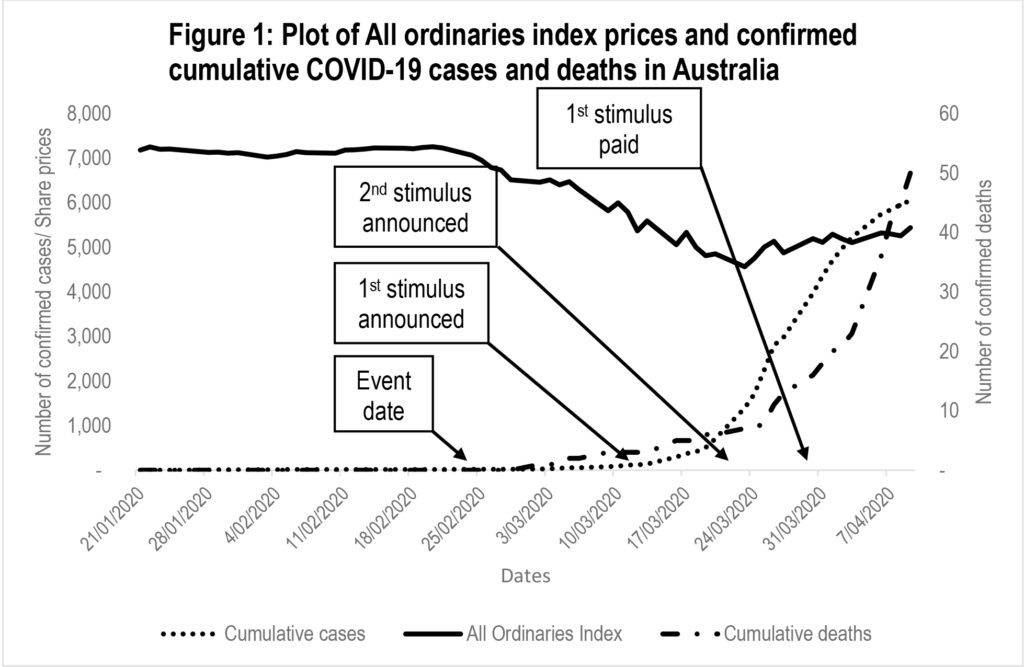

“At the beginning of the pandemic – around February 24 – information about COVID-19 was sketchy. We don’t know how long it would last or what would be the consequences, so rather than reacting straight away, the market drifted down,” Dr Naidu says.

In the market vernacular, this is known as under-reaction. It means that investors are unsure because there is not enough information to help them make investment decisions, so prices drift down.

The primary assumptions of what is known as the efficient market hypothesis (EMH) are that information is universally shared and that stock prices follow a random walk, meaning that they’re determined by today’s news rather than yesterday’s trends.

But investors are not always rational. Instead of perfectly and instantly pricing in all information perfectly, as the EMH assumes, investors and traders are driven by their emotion and faulty cognitive and behavioural biases.

Short selling trading opportunities

Using an event study methodology and a sample of 478 firms listed on the Australian Securities Exchange (ASX) they found that coronavirus fears significantly and adversely affected the returns of many sectors, small-medium and large-sized stocks.

But the research also reveals that investors may have benefited by engaging in a short-selling trading strategy.

“When we looked at the data, we realised that if investors adopted a short-selling strategy for stocks that suffered significant negative effects from the coronavirus fear and post-event return drift, they would have gained profits ranging from 2.14 per cent to 13.81 per cent,” Dr Ranjeeni says.

Government stimulus package

At the outbreak of the pandemic in Australia, the Federal Government announced a COVID-19 stimulus package that it believed would help both large and small businesses as well as individuals who would lose their jobs due to lockdowns.

What was interesting for policymakers is the speed of the evidence of reversals in stock returns, mostly following the first stimulus payment in Australia.

In their tests, the researchers found that return drift lasted for almost a month—from the event date until the payment of the first stimulus package in Australia.

“Large firms and the information technology sector were the first to experience a reversal in returns a few days following the announcement of the second stimulus package and the commencement of lockdown but before the first stimulus payment was made,” Dr Naidu explains.

“We initially thought the announcement of the stimulus package would cause the market to strongly rebound. However, this was not what we found. Instead, our research suggests that the first stimulus payment was effective in strengthening investor confidence.”

The first $750 payment was announced on 12 March 2020 as part of an economic stimulus package in response to the coronavirus pandemic.

Payments were made from 31 March 2020 to those who were in receipt of an eligible payment or who held an eligible concession card in the period 12 March 2020 to 13 April 2020.

Source: Authors, Monash Business School.

Implications for policymakers

The research also has implications for the Australian Government and policymakers by providing insights into the performance of firms across various sectors and of different sizes during the coronavirus pandemic.

Dr Naidu says the findings may be of interest to government and policymakers in their current and future decision-making processes when providing coronavirus relief assistance to affected sectors and firms of various sizes.

For instance, the government may consider aiding firms on the basis of significant adverse effects from the pandemic.

“Our results suggest that the healthcare sector and the smallest firms were the most adversely affected in Australia,” he says.

“We believe this may be of interest to the Australian Government and policymakers in their decision-making processes when providing relief assistance both now and in the future.”