The effect of US tariffs now weighs heavily on the reliability of China’s official economic data. What is China’s real growth rate?

Talks between China and the United States in recent weeks may have temporarily averted an all-out trade war between the economic superpowers, but China’s growth rate remains hard-hit by billions of dollars of tariffs the US has imposed on imported goods.

Analysts who closely monitor China’s economic and trade policies have been surprised by just how much economic conditions have weakened in the nation-state since July 2018, when the Trump administration initially levied 25 per cent import tariffs on $US50 billion of goods. A further tightening by the US in November levied 10 per cent tariffs on another $US200 billion of China’s products.

Monash Business School Associate Professor He-Ling Shi, who has closely watched China’s economic policies over several decades, believes the unexpectedly rapid downturn in economic conditions in late 2018 has convinced China’s trade negotiators of the urgent need for a deal with the US.

The Trump administration on February 24 said it would postpone a threatened further round of punitive tariffs which was due to come into effect from March 2, although the final structure of a trade deal is not yet clear. Reports indicate China may have agreed during closed-door talks in Beijing and Washington to import more US primary agriculture, including soybeans, and energy such as liquefied natural gas, while easing back on demands for US companies to partner with Chinese entities on intellectual property and technology.

While these adjustments might temporarily reduce tensions between the US and China, the underlying concerns about China’s protectionist policies remain.

Unfair trading

Professor Shi says the Trump administration’s repeated complaints about ‘unfair’ trading conditions with China were entirely justified. But he says that full appreciation of the United States’ position requires some understanding of China’s chequered progress in economic reforms since putting itself forward as a potential full member of the World Trade Organisation (WTO).

Professor Shi points out that China first sought global economic acceptance and potential admission to the WTO in 1990, less than a year after protests by progressive students, intellectuals and other activists in Tiananmen Square were viciously crushed by the military.

China in 1990 was certainly not politically ready for free trade agreements, nor was it in a position to open its borders to powerful trade alliances.

But in the next few years, China implemented tentative economic reforms in the south, opening a special economic trade zone around Guangdong and developing Shanghai as a major financial gateway. These early reforms, significantly, were championed by the then-retired chairman of the Central Military Commission, Deng Xiaoping – to the initial consternation of Deng’s political successors and Communist Party leaders.

Further gradual economic reforms followed, culminating in China’s acceptance into the WTO in December 2001 as a ‘developing’ member.

Professor Shi says the difference between being a ‘developed’ member of the WTO and a ‘developing’ one is highly significant as emerging economies are granted leniency in implementing reforms.

Effectively, China was granted a 15-year grace period to make major adjustments to its internal economic systems as part of moving towards a market-based economy. And to do so, it asked the World Bank and some developed nations to assist with advice on reform initiatives.

Policy adviser

Enter Professor Shi. In 2001, while a lecturer and researcher at Monash, he was one of a team of high-level economic consultants appointed by the World Bank, Asian Development Bank (ADB) and Australia’s Department of Foreign Affairs and Trade (DFAT), at the request of China, to assist with structural reform initiatives.

“China needed some external experts to provide policy advice about how to make China an open economy,” he says. “The biggest hurdle was the state-owned enterprises … because they were protectionist and locked up industries, preventing other companies from entering. The greatest hurdle was breaking down that mindset … and breaking down political assistance.”

“China used to have a couple of ministries, for example – a ministry of heavy industry – which controlled the SOEs. We had to abolish the SOEs and abolish the ministries,” Professor Shi says. “We needed to find a way. I provided a lot of advice on how to turn SOEs into modern corporations.”

Now what might jump out in that brief background was the 15-year grace period. Look again: the deadline for China’s transformation to a 100 per cent market economy passed in 2016, more than two years ago.

While China has been implementing reforms – “step-by-step”, as Professor Shi says – it still imposes sizeable tariffs on goods it imports, yet enjoys relatively low or zero tariffs in countries that receive its goods and services. For example, US cars exported to China are slapped with tariffs of 25 per cent compared with 2.5 per cent tariffs on Chinese-made cars sent to the US.

“China has lots of discriminated tariff assistance. They basically hand-pick their product. If the product needs a lower tariff they do that, but if they want to protect their domestic industries they raise the tariff,” Professor Shi says. “There is no consistency, and that’s why America doesn’t like it – not at all.”

Measuring economic conditions

The effects of the apparent downturn in China are ricocheting around the world. Dozens of US-based companies with sales operations in China have reported unexpectedly steep revenue falls in the December quarter. They include consumer technology group Apple, construction equipment group Caterpillar, and computer chip maker Nvidia.

But interpreting the highly dynamic Chinese economic environment can be fraught with difficulties, not least because economists retain a degree of scepticism about China’s official figures. Measuring the actual economic conditions involves weighing official reports against anecdotal evidence, and understanding the internal political momentum.

Importantly, as Professor Shi notes, much of the transactions inside China before 2010 were cash-based dealings, so they did not appear on official figures. “From what I can see and from my own studies, from the late 1970s to 2010 China’s GDP figure was under-reported,” Professor Shi says. “The actual growth was faster than the reported growth rate.”

China’s official figures indicate its average annual growth rate was 9.9 per cent from 1979-2010. Professor Shi says this was definitely under-estimated because of the strength of the internal cash economy.

The Li Keqiang Index

But after 2010, China moved strongly towards electronic funds processing and it is gradually becoming a cash-less (though not cash-free) economy. At the same time, and purely coincidentally, China’s economic growth began to taper off. Professor Shi says this was a practical example of the economic theory of diminishing returns: after an increase in capital and labour, the productivity growth tends to decrease over time.

From 2010 to 2014, China continued to report eight per cent growth – a figure Professor Shi says was over-reported. Indeed, even China’s Premier Li Keqiang in earlier years had expressed a lack of faith in the GDP figures. Professor Shi says the economic index, which now bears Li Keqiang’s name, was first adopted by the Chinese leader about a decade ago – and that, again, was as a direct result of the consultancy work done by Professor Shi and his team.

The Li Keqiang Index measures electricity consumption in China, railway transportation tonnage and loans by banks. “Have you heard about that?” Professor Shi laughs. “We gave him this advice – not just me, our team.”

He says that when he was advising on behalf of the World Bank, ADB and DFAT, his team prepared a very long report arguing that China’s national economic statistics were probably inaccurate. They suggested a more reliable indicator might be something that demonstrated usage rates, such as consumption of utilities or internal movements of cargo.

“We gave all of this advice to the State Council,” he says, intimating that the aim was transparency. Instead, layers of cloudiness emerged. It’s what Professor Shi calls the “dark side” of China’s economy.

Three sets of figures

“In China, there are three different sets of figures: one is for the local people. The second is more accurate, and it is presented to the outside world, to Western countries such as Australia. The third set of figures is the social indicators and they are only available to government officials or Party leaders. So they have a much better understanding of the course of China’s economy because they have the most accurate figures.”

“I happened to be inside during this long period of time, so I have access to these three sets of figures,” he says. “I have a very good network. It’s very senior government officials or minister – above-minister – levels, so I personally have access to all these figures. They need my advice, so I need access to accurate figures.”

The question then, that must be asked is whether China is heading in the right direction. Professor Shi is blunt: “No,” he says, “and especially not after 2016. They stopped listening to outside advice in 2016.”

He notes China by 2016 was required to eliminate the SOEs, give power back to the market, and promote private sector enterprise. In particular, China was required to wind back its policy of favouring SOEs during government procurement contracts.

But the United States and European Union in 2016 deemed China had not sufficiently reformed its economy by the 2016 deadline. “They believe China has broken the promise it made to the WTO in 2001,” he says.

Protecting protectionist policy

And why would China continue to pursue protectionist policies when it had promised to open its economy?

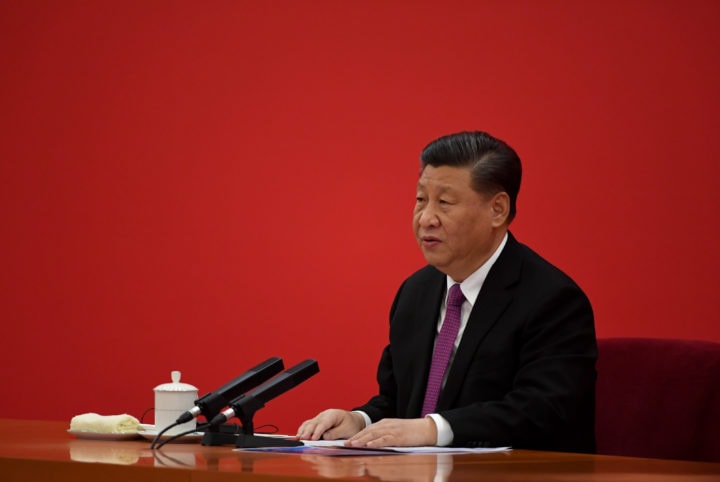

“Well, that’s a very good question and it’s all about the leader, Xi Jinping,” Professor Shi says. “It’s to do with his ideology. He has just put in place his ability to remain in place forever. His economic ideology is quite close to Chairman Mao’s – very close. That’s why he wants to change the constitution and make him become the leader permanently.”

“That is very unfortunate, actually,” Professor Shi says. “Basically, Chairman Mao’s ideology was that the Communist Party controls everything. He [Xi Jinping] still believes that SOEs should dominate. He still believes the Chinese Communist Party should play the leading role, not just in the management of the whole society, but also in the management of the whole economy. [Outside China] more and more people are realising this.”

Meanwhile, China’s official figures, released in January, indicate GDP growth eased to 6.4 per cent in the December quarter, compared with 6.6 per cent for the same period a year earlier. This is the slowest rate for almost three decades, underscoring how the punitive tariffs levied by the US since July 2018 have erased profits for some Chinese SOEs and many small- to medium-sized businesses that rely on trans-Pacific export trade.

Weak economic outlook

The outlook for the next few years appears weak, and Australian businesses that export to China are not immune.

Professor Shi notes some independent analysts believe China’s GDP rate is closer to four per cent or, indeed, much lower. He points to Xiang Songzuo, a senior economist at Remin University in Beijing, who has suggested China’s economic growth rate may be around 1.67 per cent, a long way from the government’s reported growth rate and dramatically below the four per cent unofficial growth rate Professor Xiang calculated a year earlier.

Even discounting the doomsday forecasts, the stakes in these trade talks between the US and China are high. Failure could push China to a much slower pace of growth, Professor He-Ling says, and that could bring global economic conditions to the most perilous position since the 2008-2010 downturn.

“Chinese leaders are very keen to resolve this,” Professor Shi says. “But I don’t know what is going to happen. I am anxious just waiting for an outcome. I can say, we are living in very, very interesting times.”