Far from providing an opportunity for global dominance, COVID-19 has revealed the great weaknesses in China’s economy.

As the coronavirus sweeps across Western economies, some observers have argued that this may be China’s opportunity to increase its global economic dominance.

But rather than presenting an opportunity, as the US and other major western countries come to a virtual standstill, the impact of COVID-19 could severely impact on China’s economy and push millions into poverty, according to He-Ling Shi, Associate Professor at Monash Business School’s Department of Economics.

A long-time expert on the Chinese economy he also serves as a senior consultant to both the World Bank and the Asian Development Bank.

The COVID-19 outbreak and ensuing lockdown has caused China’s economy to officially shrink by a startling 6.8 per cent in the first quarter of 2020. This is the first quarterly contraction since such records began in 1992 and the first official contraction since 1976 admitted by policymakers, who are notorious for being reluctant to officially publish statistics.

While the popular view is that China will lead the world on an economic recovery, the fact is that China is heavily reliant on foreign exports, particularly from the US.

And more than 60 per cent of China’s export commodities are produced by small to medium enterprises (SMEs), which have been severely hit by the shutdown.

“China is heavily reliant on exports. Even if it can fully recover from COVID-19, the lack of exporting opportunity will still hurt the Chinese economy. This is to against a popular view that China will lead the world if she can recover from COVID-19 first,” Associate Professor Shi says.

Falling exports

It could be a while until the world realises just how much of a toll falling exports has taken on the economy. Even with a drop of 6.8 per cent in GDP, according to associate Professor Shi, we are not likely to hear the true picture of the economy.

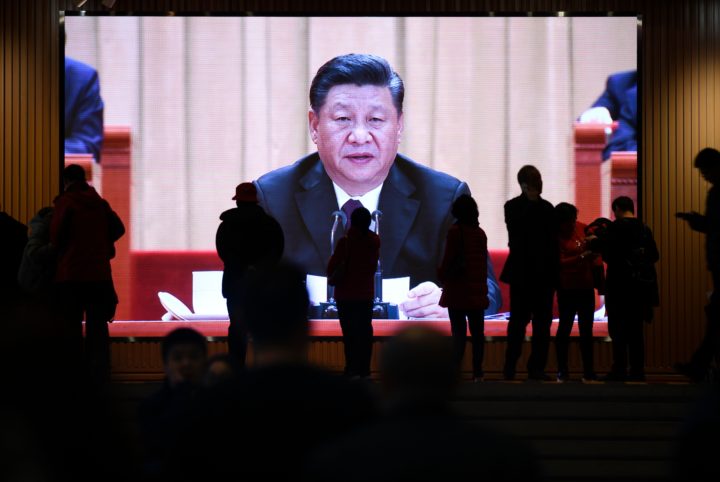

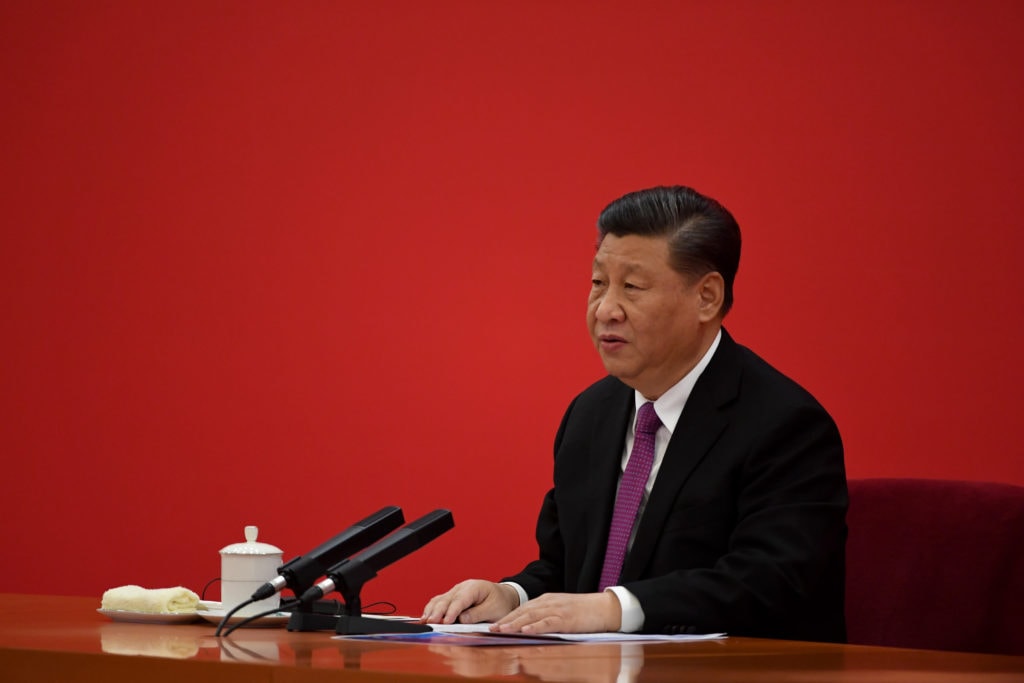

“In China, the National Bureau of Statistics (NBS) collects GDP data. Before it publishes the data, it will seek approval from the NDRC (National Development and Reform Commission, equivalent to Australia’s Department of Treasury) – which in turn will seek approval from the Standing Committee of the political bureau of the Communist Party of China (CPC),” Associate Professor Shi says.

“China will not let the world know the real numbers and they will especially keep the consequences from the Chinese people.”

As the world’s factory, the Chinese economy relies heavily on exports, which have grown to account over the past 10 years to account for about 20 per cent of China’s Gross Domestic Product.

“About 20 per cent of China’s annual products and services are exported to foreign countries,” Associate Professor Shi says. “By way of comparison, during the same period, exports in the US accounted for only 12 per cent of GDP.”

Nowhere is this vulnerability to a downturn more apparent than in its trade relationship with the United States.

In 2018, China had a $420 billion trade surplus against the US in 2018, which was reduced to $350 billion following tit-for-tat trade sanctions implemented by President Donald Trump, who argued its trade deficit against China had cost American jobs.

Small business slump

As relations deteriorate between the two countries, any slump in trade with the United States will be particularly keenly felt by China’s SMEs, which produce more than 60 per cent of the country’s export commodities of textiles, footwear, electronic appliances and groceries. Most of these are labour-intensive enterprises.

As these SMEs employ 80 per cent of the urban labour force and contribute 90 per cent of new jobs, the country is now facing a real risk of mass unemployment.

A sluggish recovery following the severe economic contraction could see 11 million people tumble into poverty.

“A large number of SMEs rely on thin cash flow to maintain production, without having sufficient buffers. It has been reported that most SMEs in Zhejiang province in Eastern China could only last for three months without permanently closing down if the status quo maintains,” Associate Professor Shi says.

Mass unemployment is likely to follow, with “very severe” impacts, he warns.

“The vast majority of Chinese do not have sufficient savings, nor the protection of any kind of insurance policy.

“Many families rely on their main labour force to work continuously to maintain their livelihoods. Once work stops, subsistence could become an urgent issue.”

Boost domestic demand?

So with plummeting demand from western economies, China is seeking to boost demand for its goods and services at home. But with fears of growing unemployment how it’s not certain how realistic this option could be.

“They are definitely trying to boost domestic demand. The Chinese government learned a lesson from the US-China trade conflict – that over-reliance on foreign demand would add significant uncertainty and fluctuation on the long-term economic development in China,” he says.

“Consequently, the State Council has published a series of economic policies to boost domestic demand. The implementation of these policies was sped up after the COVID-19 outbreak.”

Some provincial governments, for example, are instructing their officials to spend a minimum amount on dining-out and other consumptions after the lift of COVID-19 lockdown.

Unlike in Australia, where the Federal and state governments are providing fiscal stimulus to help consumers and small businesses, China’s stimulus will likely concentrate on public investment, as it has before.

“China will invest trillions of dollars on infrastructure for high-tech and sustainable purposes, such as 5G networks, further expansion of the high-speed train networks and creation of some megacity clusters,” Associate Professor Shi says.

Whether these measures will work remains to be seen. The world’s second most powerful economy is facing its biggest test.