As the COVID-19 pandemic continues to menace Australia’s economy, new consumer research gives some hope to retailers.

Under Australia’s first COVID-19 lockdown, shoppers flocked to online marketplaces and turned to online shopping channels – many for the first time – but remained loyal to their favourite brick-and-mortar stores, turning to them for trusted information about purchases.

These are among the key insights into Australia’s retail landscape and the minds of consumers gathered by Monash Business School’s Australian Consumer and Retail studies unit (ACRS), which conducted its annual Retail Monitor survey of 500 shoppers in May, at the start of the initial COVID-19 lockdown.

For retailers, trends like this underline the need to be nimble in responding to consumer needs, with those who have managed to do this weathering the COVID storm best, says Dr Eloise Zoppos from the ACRS unit.

Dr Zoppos says shoppers turned to online shopping channels for the first time or more regularly as bricks-and-mortar stores were closed, with many expecting to use online channels more in the next six months due to the coronavirus restrictions.

“Many shoppers used online shopping channels like marketplaces (such as Facebook Marketplace and Gumtree) for the first time during the shutdown when physical stores were no longer open,” Dr Zoppos says.

“And they expect that they will be using online channels more in the second half of the year, suggesting they have become more comfortable and confident in their use.”

Spending down, but still shopping

ABS Data shows discretionary spending was generally down at the start of the lockdown, with consumers funnelling their spending into food and items for home offices, appliances and gardening.

However, the ACRS retail survey of 500 Australian shoppers found 70 per cent had still purchased clothing, footwear and accessories during the six-months prior. It also showed they still preferred to shop in a physical store, with 59 per cent of total consumer spend made in physical stores across all product categories when they had the chance.

While retailer websites were the most popular channel for product or price comparisons, physical stores were most commonly used for product information.

“This was a little bit surprising at first, as in the past we’ve seen that people tend to look online for product information, but now it seems more and more consumers like to learn about product information from staff located in physical stores,” Dr Zoppos says.

“For retailers, this means staff are relied on as product experts and must be up-to-date with the best information possible so they are able to answer any consumer questions.”

Physical stores are also a key source of information when making the decision about which brand to buy, with 65 per cent of respondents researching their brand information here compared to 55 per cent from the retailer website.

“People want to have the opportunity to ask questions. It seems that often, brands don’t have all the information on their website, or the information customers need is not in a place they can easily find it. People want to talk to a sales assistant, not a chatbot,” she says.

Cleaning out the cupboards

Online marketplaces grew in popularity, accounting for 10 per cent of consumer spend, only just behind retailer websites at 15 per cent and online-only retailers like fashion store ASOS and shopping platform Kogan, at 11 per cent.

“We’ve seen online marketplaces like Facebook Marketplace and Gumtree become more popular in the last few years, and even more so during COVID,” Dr Zoppos says

“As people have been stuck home during the lockdown, they’ve used that opportunity to clean out their wardrobes and homes, and a lot of those products were sold on sites like Facebook Marketplace and Gumtree and bought by shoppers looking for a bargain.”

The survey found household items and personal care products were popular purchases (54 per cent and 52 per cent, respectively), while the popularity of consumer electronics and media and entertainment products grew (32 per cent and 26 per cent, respectively).

“Consumer electronics and media and entertainment items – items like TVs, DVDs X-Box consoles, and computer monitors – were even more popular during the lockdown, as people want to be entertained while staying at home,” Dr Zoppos says.

What a year for retail

In January 2020 consumers were reeling from a long list of retail closures, uncertain if this was the beginning of the end for retail as we know it.

Back then, Dr Zoppos argued Australian retailer were experiencing a shift in power from retailer to consumers.

With the COVID-19 shutdown hitting Australia just months later, retailers that were not well placed for agility have suffered, with many closing their doors.

But other retailers which depend on discretionary spend have been innovative and found opportunities in the crisis, Dr Zoppos says.

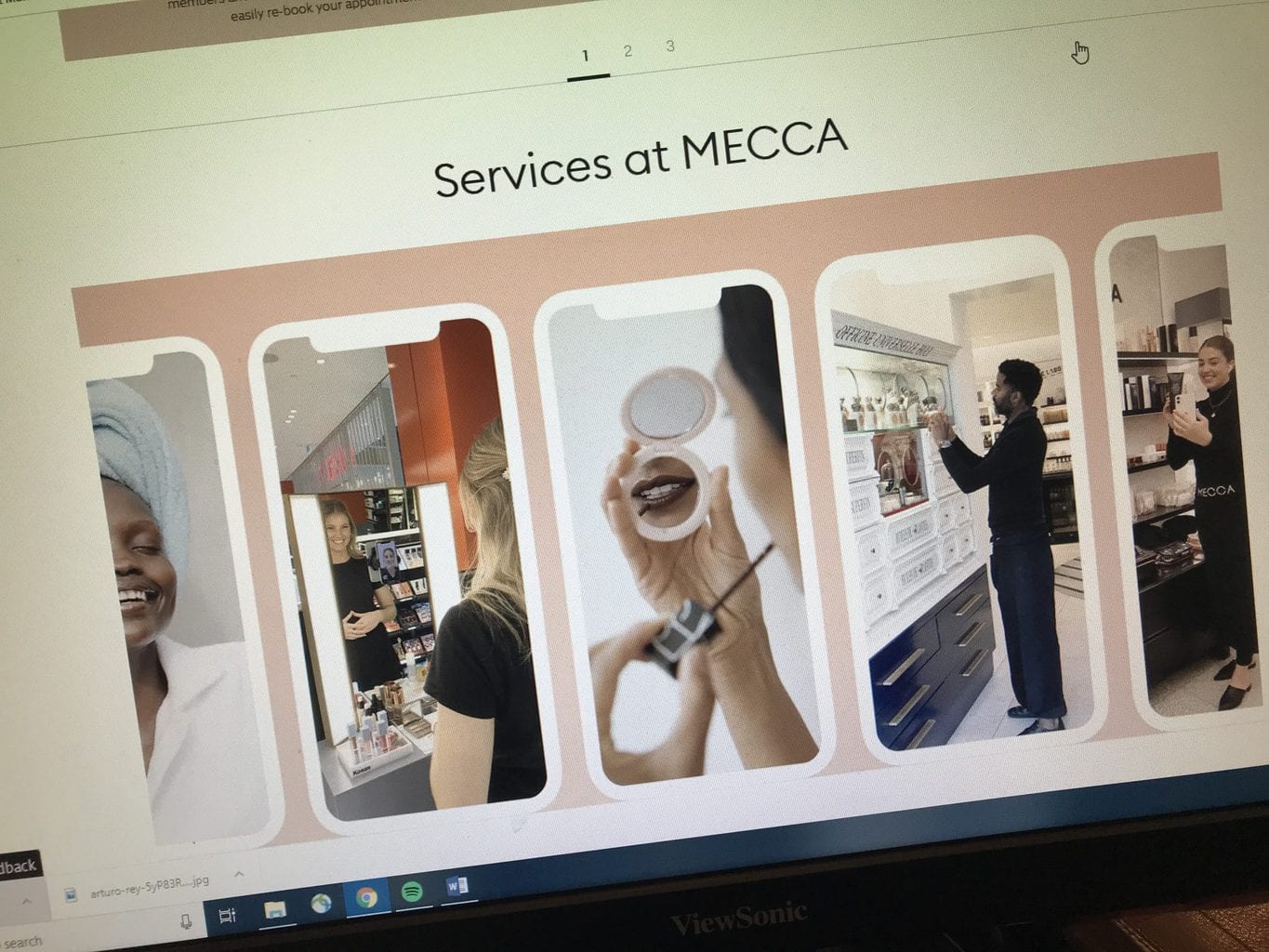

She points to leading cosmetic retailer Mecca, which rapidly adapted to a COVID lockdown by offering customers other ways to source their beauty needs.

“After their doors closed, Mecca was one of the first to replicate their service online,” Dr Zoppos says. “Customers were able to book a FaceTime virtual consultation with a staff member who was in the store.”

Many customers trying to order goods from a host of online retailers at the time experienced long wait times – delays of up to a couple of weeks in some cases – where retailers experienced huge increases in online sales and warehouse and supply chain providers grappled to keep up with demand.

Delivery and courier services such as Australia Post rallied to boost their capacity.

“At the Mecca virtual session, the consultant shows different products and then packs and ships them straight away directly from the store, giving those customers the edge over people who had just purchased on the website,” Dr Zoppos says.

Carlton & United Brewery (CUB) also introduced its ‘For the love of your local’ campaign in which customers purchased drinks for some time in the future when pubs could open again. CUB matched the customer drink-for-drink, giving them a 2-for-1 deal and helping their venues by boosting cash flow.

“It’s been a tumultuous first half of the year, but retailers who are nimble, agile and prepared to adapt to new consumer and shopping behaviours, are going to be successful in the long-term,” Dr Zoppos says.